Bucharest, December 10, 2025. Prices for “prime” and “ultra-prime” properties in ski resorts increased in 2025 by 3% and 9% respectively, compared with the previous year. The Aspen ski resort in Colorado, United States, tops the ranking of the most expensive properties, with a price of 68,900 euro per square metre in the ultra-prime segment and 35,100 euro per square metre for prime properties, according to the Savills Ski Prime Price League index, which analyses properties priced above 750,000 euro. The next two positions are occupied by Val d’Isère (52,100 euro/sq m and 32,500 euro/sq m respectively) and Gstaadt (51,500 euro/sq m and 30,700 euro/sq m respectively).

„For now, it is scarcity and equity that define and influence property markets in the Alps and mountain resorts globally. Today, wealthy buyers value lifestyle, comfort and exclusivity and are willing to pay for it”, says Jeremy Rollason, Head of Savills Ski, in The Ski Report, Winter 2025-261.

Despite ongoing economic uncertainty, prime ski property markets have shown remarkable resilience. Unlike the mass residential markets, where lending plays a central role, buyers in this segment tend to rely to a much greater extent on their own equity. This has helped shield the market from interest rate volatility and broader financial pressures.

Although prices remain 4% below the peak reached in 2022, they are still 12% higher than in 2021 and 27% above pre-pandemic levels. For many buyers, purchasing a prime property in a ski resort is not only a financial decision, but also an emotional one. These homes often function as long-term family assets, combining investment value with personal attachment.

Swiss resorts dominate the ultra-prime market

The world’s top 10 ski resorts in terms of ultra-prime residential prices have remained almost unchanged over the past two years. Swiss resorts dominate the upper end of the market, accounting for half of the positions in the top 10. However, aggregate figures tell only part of the story. In Switzerland, many of the truly desirable properties are traded off-market, bypassing public listings altogether. These discreet transactions often achieve prices ranging from 40,000 to over 75,000 euro per square metre, reflecting the rarity and exclusivity of the ultra-prime stock.

French resorts also hold an important position, accounting for one third of the Savills Ultra-Prime Price League. Val d’Isère and Courchevel 1850 lead the French market, with top-tier properties frequently exceeding 40,000 euro per square metre.

Across all leading resorts, supply constraints remain a defining feature. Whether due to planning regulations, limited land availability or conservation policies, there are very few new developments coming to market. This persistent imbalance between demand and supply continues to support high price levels, reinforcing the exclusivity and long-term value of ultra-prime ski properties.

What is the situation in Romania?

Based on the experience of Alpine ski destinations, as reflected in the Savills Ski Report, the increase in prices in the prime and ultra-prime residential segments began with the entry, from 2015 onwards, of major hotel chains into this segment. These investments were driven by growing tourist interest; visitors then wanted to purchase properties in those resorts, which led to a significant rise in demand and, implicitly, in prices, against a backdrop of relatively limited supply.

Although the current market climate does not yet allow Romania’s mountain destinations to fully transition into genuine ultra-prime or prime segments, these areas continue to show strong development potential.

“In the residential segment, prices in ski-oriented areas such as Brașov or Sinaia are currently between 3,000 and 4,000 euro per square metre, far from the Top 10 residential markets in ski destinations, but relatively close to resorts such as Furano or Bad Gastein”, explains Oana Popescu, Partner & Head of Residential at Crosspoint Real Estate, International Associate of Savills in Romania. “The elements that have driven growth in the residential markets of Alpine ski destinations are also emerging in Romania’s ski segment: rising tourist interest1, investments already made, and more than 1,000 hotel rooms planned in the coming period in mountain areas”, adds Oana Popescu.

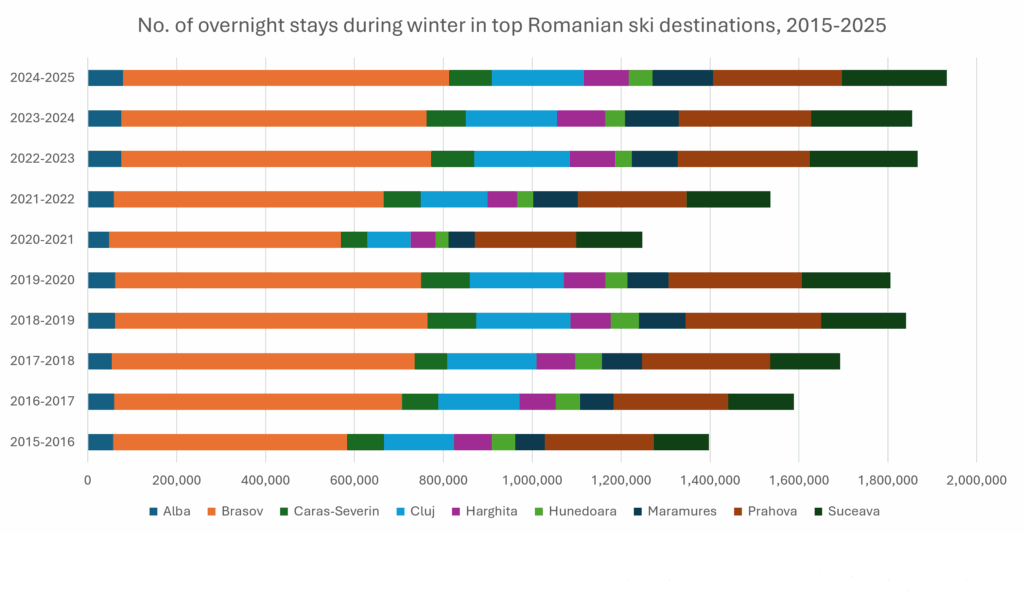

The 2024–2025 winter season recorded the best performance ever in Romania’s major ski destinations, reaching 1.93 million overnight stays, up 4% on the previous year and 7% above the level of the 2019–2020 season, according to INS (National Institute of Statistics) data – see infographic

The investments announced by major hotel chains are particularly visible in the Brașov area. After last year’s opening of the Swissôtel, Hyat Regency recently announced it will renovate the famous Aro Palace, while brands such as Kempinski, Mercure, Marriott, Hilton and Ibis have also announced investments in the local hotel segment. Encouraging signs are also emerging from other mountain resorts in the Bucegi area, such as Sinaia, where Hotel Cota 1400 has recently entered into an extensive renovation process.

Read the full report here.