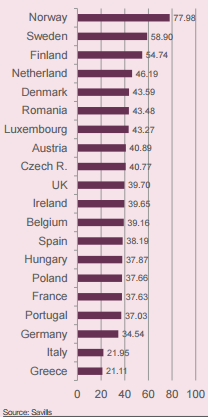

Romania ranks 6th in the top destinations in the datacentres market in Europe, while the Nordics and the Netherlands occupy the first positions, according to Savills new Data Centre Investment Index. The number of datacentres is multiplying to accommodate the surging demand for data storage. Thus, the need to have smaller scale domestic facilities to comply with data and privacy laws is set to lead to an uptick in activity across all of Europe.

Most of the world‘s datacentres are currently based in the US, but also in the UK, Germany, France and the Netherlands. However, this geographical distribution could well change soon. Datacentres no longer have to be located close to their clients but can be located in countries where clean energy is abundant and cheap as long as connectivity is safe and fast. Data, after all, is the most mobile commodity on earth and datacentre service companies can choose where to locate their premise in order to reduce their operating costs.

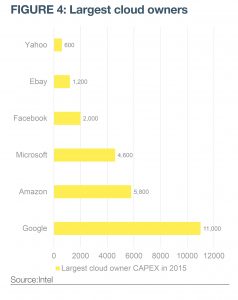

Given the fact that datacentres require energy and water, in order to keep the servers cool (3-4% of the world power is used by datacentres), there is great concern regarding their carbon footprint similar to the aircraft industry. Therefore, there is a focus on using environmentally-friendly technologies in the mega datacentres built mainly by Internet giants and cloud companies such as Google, Facebook, Apple, Amazon and Rackspace.

Given the fact that datacentres require energy and water, in order to keep the servers cool (3-4% of the world power is used by datacentres), there is great concern regarding their carbon footprint similar to the aircraft industry. Therefore, there is a focus on using environmentally-friendly technologies in the mega datacentres built mainly by Internet giants and cloud companies such as Google, Facebook, Apple, Amazon and Rackspace.

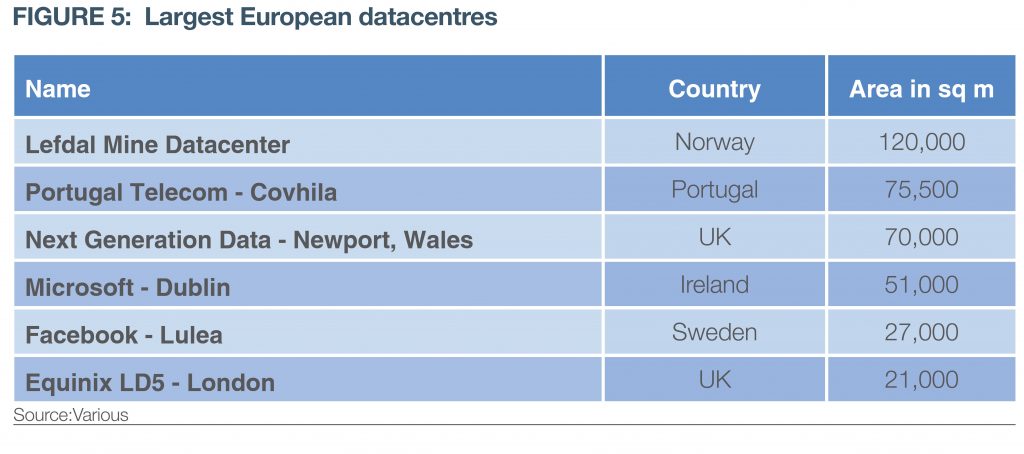

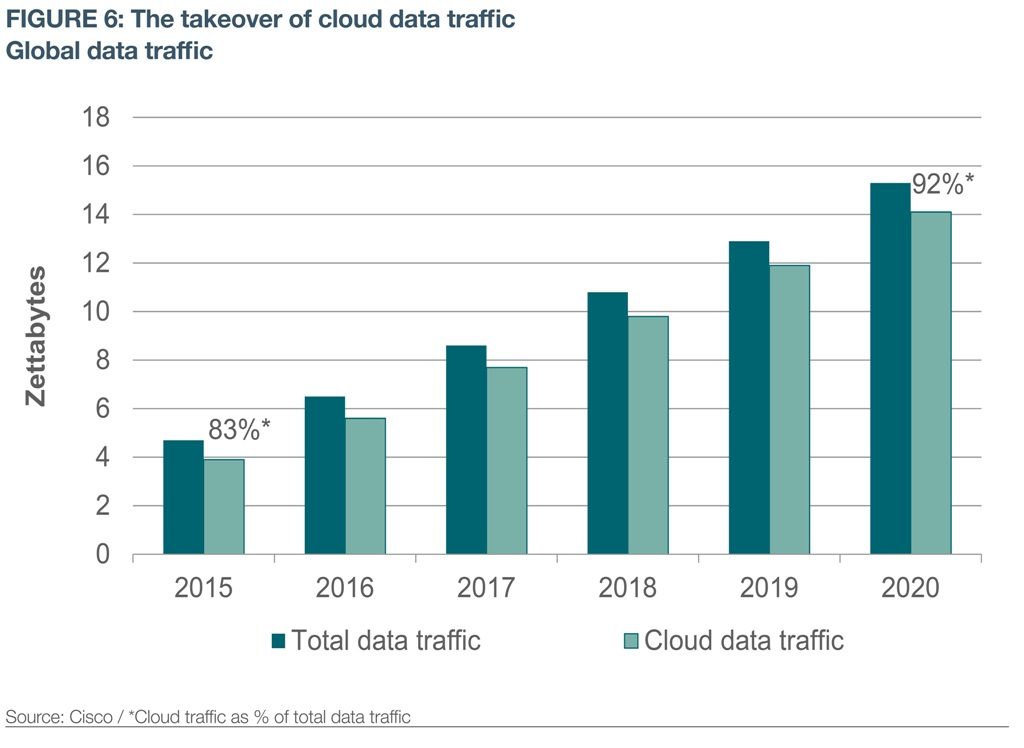

According to Savills, owing to the growing popularity of cloud-based infrastructures, the need for cost-effective hyper-scale data centres of 50,000+ sq m in Europe has grown exponentially over the past five years, with Cisco predicting that hyper-scale data centre traffic will quintuple over the next five years.

Savills has therefore identified the best locations in Europe in which to invest, benchmarking 20 countries against 12 indicators crucial to the development of datacentres*. Surprisingly, Romania ranks 6th of the top 20 countries in Europe for data centre investment, right after the Nordics. The Nordic nations take four of the top five slots, given their strengths in offering low energy costs, cool weather and access to water, with the Netherlands rounding out the top five.

Codrin Matei, Managing Partner and Head of Capital Markets for Crosspoint in Romania, comments: “Romania has seen an accelerated development from the perspective of the IT & C industry, backed by the market entry of renowned companies (Amazon, Fitbit) and by the expansion of existing major players (Microsoft, HP). From this perspective, the rise of investment in data centres will just be a matter of time and they will probably target Bucharest and IT hubs such as Cluj, Timisoara, Iasi.”

Codrin Matei, Managing Partner and Head of Capital Markets for Crosspoint in Romania, comments: “Romania has seen an accelerated development from the perspective of the IT & C industry, backed by the market entry of renowned companies (Amazon, Fitbit) and by the expansion of existing major players (Microsoft, HP). From this perspective, the rise of investment in data centres will just be a matter of time and they will probably target Bucharest and IT hubs such as Cluj, Timisoara, Iasi.”

With data centre occupiers taking leases of 10 years or more, and an increasing number looking towards sale and leaseback options, the sector offers investors an appealing proposition. Data Centres are increasingly an investment product category accepted by institutional investors such as AXA and CBRE Global Investors, and the weight of money has pushed yields down significantly over the last couple of years to 5-7%. We expect these yields to move in further in the coming months and years.”

Datacentre investment REITs are the most active buyers in the sector, notably US Equinix REIT, the Asian Keppel DC REIT and the US Digital Realty, says Savills, but as the market grows it is slowly opening to non-specialist investors (investment managers and general REITs).

Lydia Brissy, European research director, says: “New datacentres are increasingly concentrating in suburban or rural areas in countries that offer the best opportunities in terms of natural environment, security, energy and connectivity, with the Nordics being the location of choice for hyper-scale facilities. But there’s still a need for small and medium-sized centres, nationally based, to mitigate any potential latency and also to avoid legal issues relating to data sovereignty. This means that countries such as the UK, Germany France and the Netherlands will continue to witness an increasing demand for data storage and corresponding investor activity.”

*The Savills Data Centre Investment Index benchmarks 20 countries against 12 indicators crucial to the development of datacentres: average annual temperature; the average temperature during the peak month of the year; the availability of fresh water per capita; the average annual loss liaised to natural disasters; political instability; cybersecurity; the electricity production per capita; electricity price; the availability of green energy per capita; the internet average speed and the FTTH/B (fibre to home / fibre to building) penetration rate. The various indicators have been graded and ranked across the 20 countries (Austria, Belgium, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Romania, Spain, Sweden and the UK).